Western National Life Insurance Company WNL 162 2011-2026 free printable template

Show details

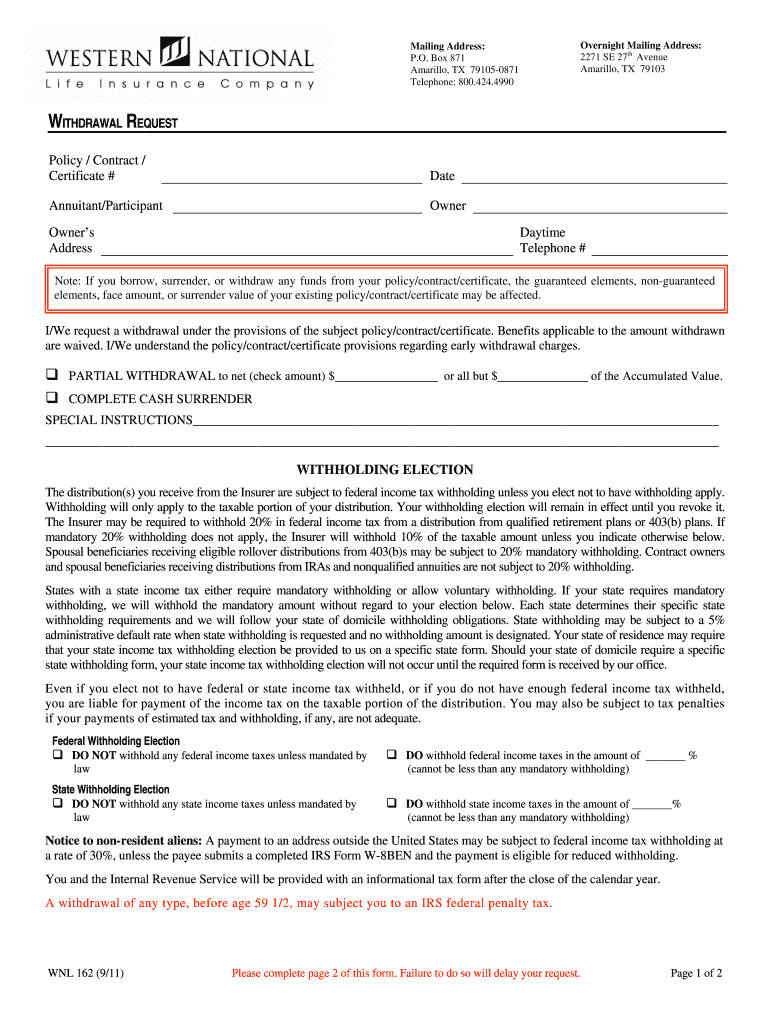

Mailing Address: P.O. Box 871 Amarillo, TX 79105-0871 Telephone: 800.424.4990 Overnight Mailing Address: 2271 SE 27th Avenue Amarillo, TX 79103 WITHDRAWAL REQUEST Policy / Contract / Certificate #

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign national western annuity forms

Edit your wnl annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your american general annuity withdrawal form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit aig annuity forms online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit american general annuity forms. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

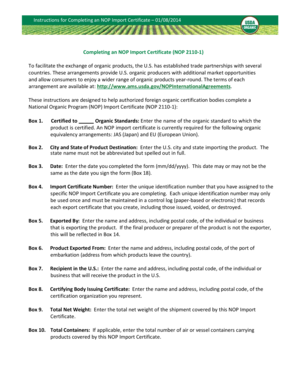

How to fill out western national life forms

How to fill out Western National Life Insurance Company WNL 162

01

Obtain the Western National Life Insurance Company WNL 162 form.

02

Read through the instructions carefully to understand all required information.

03

Fill in your personal information, including your name, address, date of birth, and social security number.

04

Provide information about your health history and any existing insurance policies.

05

Select the type of coverage you are applying for and specify the coverage amounts.

06

Complete the beneficiary section by naming individuals who will receive the benefits.

07

Review the completed form for accuracy and completeness.

08

Sign and date the application where required.

09

Submit the form to Western National Life Insurance Company along with any required documentation.

Who needs Western National Life Insurance Company WNL 162?

01

Individuals seeking financial protection for their loved ones in the event of their death.

02

People looking for an investment or savings component alongside life insurance.

03

Parents wanting to ensure their children's future finances are secure.

04

Workers looking to supplement their employer-sponsored life insurance plans.

05

Individuals with dependents or significant debts that need coverage through life insurance.

Fill

corebridge withdrawal form

: Try Risk Free

People Also Ask about corebridge annuity forms

Is AGL the same as AIG?

American General Life Insurance Company was established in 1960. As American General expanded its national presence and added new financial products and services over the years, the company was acquired by American International Group (AIG) in 2001.

Is American General Life still in business?

AIG Life & Retirement is now Corebridge Financial.

Is American General life insurance the same as AIG?

American General Life Insurance Company is a wholly-owned subsidiary of AGC Life Insurance Company (AGC Life or the Parent), an indirect, wholly-owned subsidiary of American International Group, Inc. (AIG Parent). The Company is a stock life insurance company domiciled and licensed under the laws of the State of Texas.

Who owns AIG now?

American International Group Inc (NYSE:AIG) Institutional investors hold a majority ownership of AIG through the 92.38% of the outstanding shares that they control. This interest is also higher than at almost any other company in the Multi-Line Insurance industry.

Who bought American General life insurance?

On August 29, 2001, the Transaction was completed. As a result of the Transaction, AGL is now an indirect, wholly-owned subsidiary of AIG.

Is American General Life Insurance Company a legitimate company?

It is one of the most highly-rated life insurance providers in the nation. Garnering above-average ratings from all four financial strength agencies, AIG offers affordable rates as well as flexible premium and benefit packages.

Does AIG have another name?

A.I.G. changed the name of the worldwide holding company for its property and casualty unit to American International Underwriters in early March. The renamed A.I.U.

What companies are under AIG?

They include AIG Casualty Co.; AIG Centennial Insurance Co.; AIG Premier Insurance Co.; AIU Insurance Co.; American General Indemnity Co.; American Home Assurance Co.; American International Insurance Co. of California Inc.; Birmingham Fire Insurance Co.

What happened to American General life insurance?

AIG Life & Retirement is now Corebridge Financial.

What happened to American General Life Insurance Company?

American General Life Insurance Company was established in 1960. As American General expanded its national presence and added new financial products and services over the years, the company was acquired by American International Group (AIG) in 2001.

Is American General life still in business?

AIG Life & Retirement is now Corebridge Financial.

How do I contact American General life insurance?

Contact Us AIG Direct Sales. (800) 294-4544. Monday - Friday. 6:00 am to 6:00 pm (PST) Saturday. 7:00 am to 4:00 pm (PST) AIG Direct Customer Service. (888) 517-9797. Monday - Friday. 7:00 am to 5:00 pm (PST) General. Contact Info. AIG Direct. 9640 Granite Ridge Drive, Suite 200. San Diego, CA 92123. (858) 309-3000.

Who took over American General Life Insurance Company?

After continuing its acquisition spree in the 1990s, AG was itself bought up in 2001 by American International Group, Inc. (AIG).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify corebridge financial withdrawal form without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including corebridge annuity withdrawal form, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I execute corebridge financial withdrawal form pdf online?

pdfFiller has made filling out and eSigning aig site pdffiller com site blog pdffiller com easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I complete corebridge financial lifeform on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your corebridge financial forms pdf from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is Western National Life Insurance Company WNL 162?

Western National Life Insurance Company WNL 162 is a form used by the company for reporting specific information related to their insurance policies, claims, and financial activities.

Who is required to file Western National Life Insurance Company WNL 162?

Organizations or individuals who hold policies with Western National Life Insurance Company and are required to report certain financial or claims-related information must file WNL 162.

How to fill out Western National Life Insurance Company WNL 162?

To fill out WNL 162, the filer must gather all necessary information related to their insurance policies and claims, complete each section of the form accurately, and submit it to the appropriate department within the company.

What is the purpose of Western National Life Insurance Company WNL 162?

The purpose of WNL 162 is to provide a standardized way to report and track information pertinent to policy details, claims submissions, or financial disclosures required by the company.

What information must be reported on Western National Life Insurance Company WNL 162?

Required information on WNL 162 typically includes policyholder details, policy numbers, types of insurance, claim information, and any financial transactions pertinent to the reporting period.

Fill out your Western National Life Insurance Company WNL online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corebridge Annuity Withdrawal Forms is not the form you're looking for?Search for another form here.

Keywords relevant to corebridge withdrawal form pdf

Related to western national life annuity

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.